DeFi

Since December 2020, Ethereum traders have been in a position to take part within the community’s staking mechanism, securing the community within the course of. Nonetheless, to stabilize this safety, Ethereum builders determined to lock up these funds, till just lately, on April twelfth. This was when the much-appreciated Shapella improve occurred, unleashing liquidity gates.

Nonetheless, from December 2020 to April 2023, DeFi platforms provided Ethereum customers a approach to circumvent the lock-up interval – liquid staking. The three massive ones are Lido, Rocket Pool, and Ankr. These platforms locked customers’ ETH funds for them in change for receiving liquid staking tokens.

Liquidity Dominos Fall Into Place

Within the case of Lido, that is stETH, equal to ETH worth in a 1:1 ratio, however unlocked for use throughout Ethereum’s many DeFi dApps for loans and yield farming. Lido is by far the most important liquid staking protocol, at $12,06 billion complete worth locked (TVL).

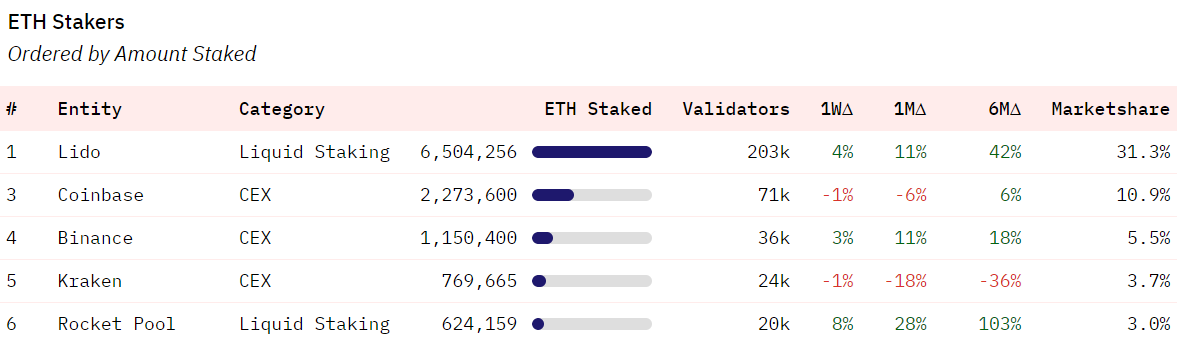

Lido cornered the market on Ethereum’s staking, at 31.3% marketshare. Picture credit score: Dune analytics through @hildobby

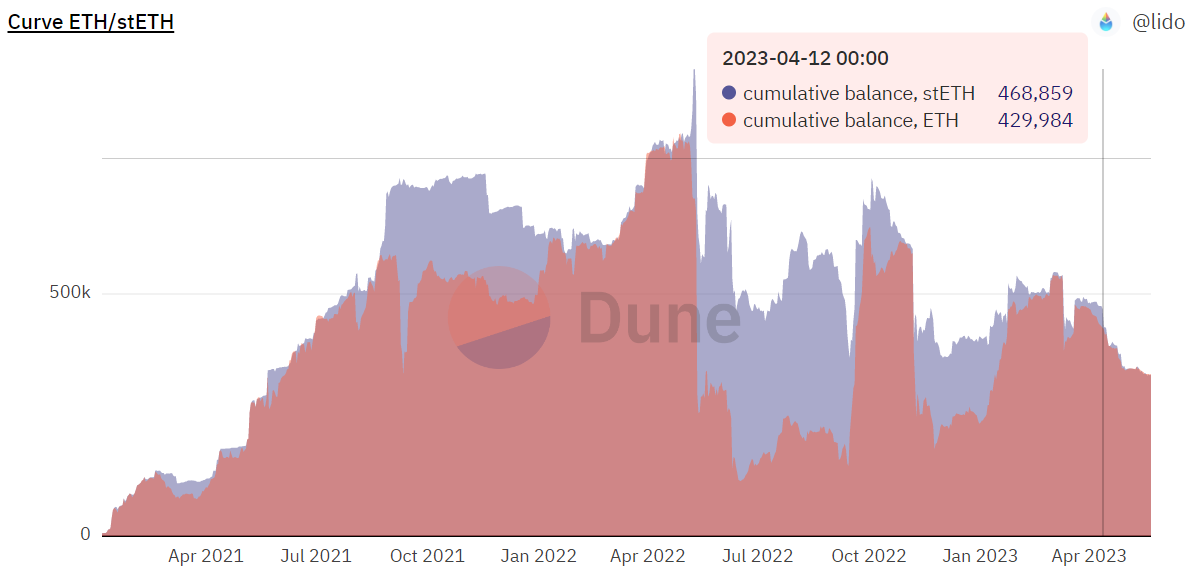

Conversely, Curve DeFi protocol is the most important liquidity supply for stETH tokens for use. For the reason that Shapella improve went reside on April twelfth, there was a pointy drop in Curve’s stETH-ETH pool—the anticipated liquidity exit totals round $424.9 million.

- From 468,859 stETH to 331,891 stETH, a 29.21% lower ($249.3 million)

- From 429,984 ETH to 333,483 ETH, a 22.4% lower ($175.6 million)

Nonetheless, it is usually noticeable that the Curve stETH-ETH pool is now practically completely balanced.

Since Could 2022, the pool has develop into imbalanced in favor of stETH, and once more in January this yr. Picture credit score: Dune analytics through @Lido

With customers holding each stETH and ETH in equal measure, this means that Lido rewards are nonetheless ample to entice liquid staking. These are issued by Lido DAO (decentralized autonomous group) within the type of LDO token rewards.

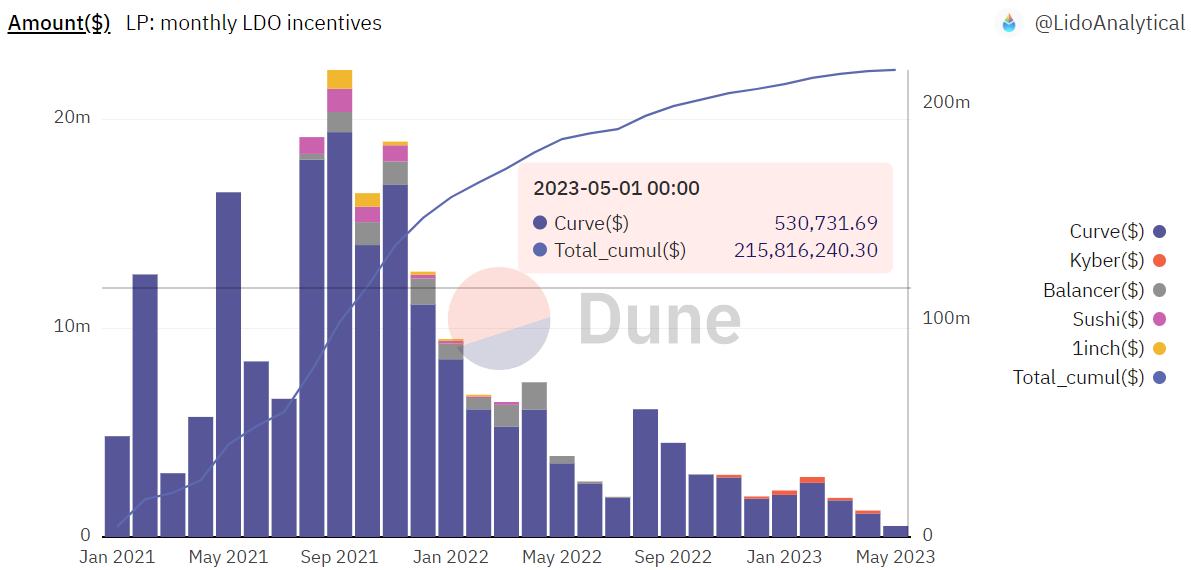

Picture credit score: Dune analytics through @LidoAnalytical

As soon as once more, simply as Lido dominates liquid staking, Curve (blue) stays the go-to pool for month-to-month LDO incentives, additional explaining the now-balanced stETH-ETH ratio.

What About General Ethereum Deposits?

Though Ethereum has develop into deflationary, at -0.307% for the reason that Merge on September 15, 2022, ETH value has elevated solely 15%. Nonetheless, ETH is up 51% YTD because the US banking disaster took the general public highlight and the Bitcoin rally reinvigorated the crypto market.

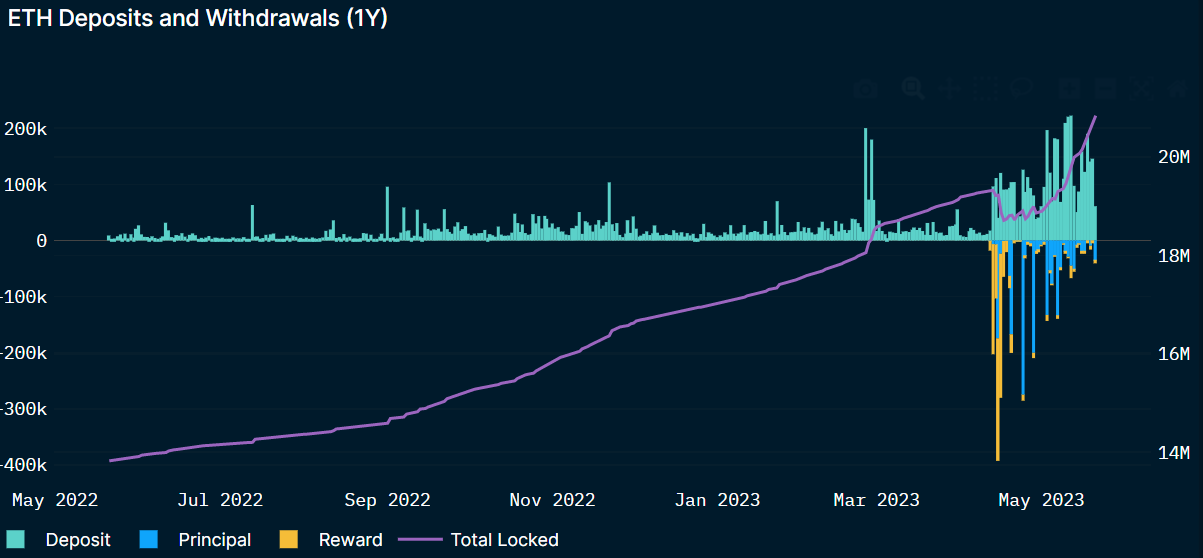

Extra importantly, when Shapella withdrawals had been enabled, considerations concerning the liquidity loss of life spiral turned invalid. As an alternative of promoting stress, extra deposits befell. After some withdrawal sprees in April, the overall quantity of ETH locked is now greater than earlier than the improve, at 20.8 million ETH (~$37.9 billion).

Picture credit score: Nansen.ai

Sadly, with reputation comes community congestion, which Ethereum is but to deal with with the Surge improve that scales Ethereum with information sharding. Suffice it to say; for Ethereum to develop into the DeFi’s infrastructure for international mass adoption, its fuel charges must be low and persistently so.